Our Top Recruiters

Program & Placement Snapshot

₹8.02

Program Fee

₹8 LPA

Average Salary

₹12 LPA

Highest Salary

₹30 LPA

*Career Trajectory Within 3 Years

~15 Months

ROI Horizon

60 Students

Intake

*Projections based on alumni and market data; outcomes depend on individual performance.

100% Tuition Fee Scholarship

Available for CAT 95+%ilers candidates.Other CAT takers can apply for Scholarship Test.

Enquire Now

Why us?

FFOI Powered-PGDM Finance

Enquire Now

Who Should Apply?

Enquire Now

Apply Now

Industry Potential

Global Capital Markets

Investment Banking Revenues

Hedge Fund AUM

Derivatives Market

Risk & Quant Infrastructure

Know More

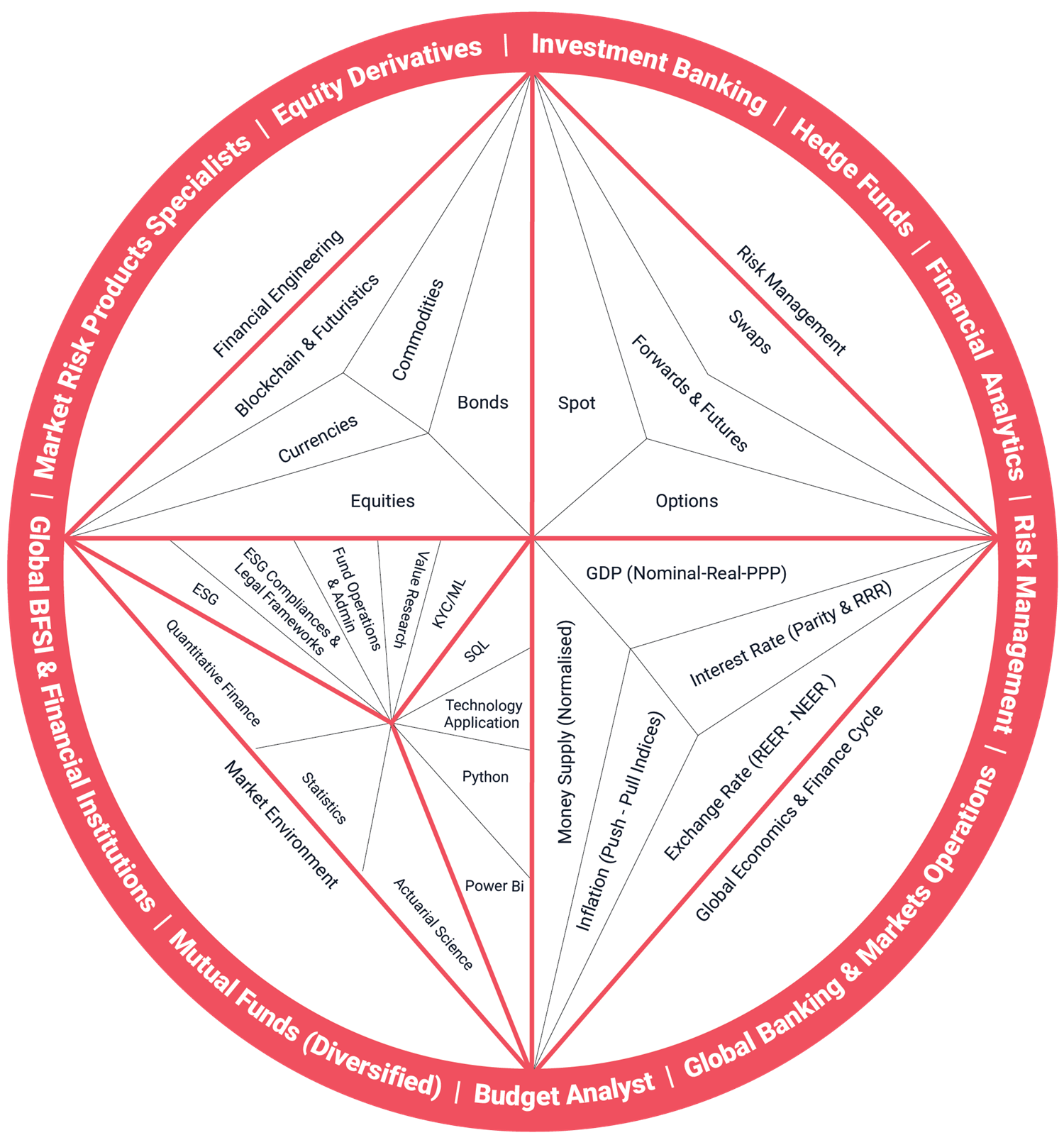

Illustrative Career Paths

Curriculum Overview

Future-Ready Pedagogy

A future-ready pedagogy shaping leaders in Financial Engineering.

Theory Meets Practice

Where theory meets real-world finance and market excellence.

Analytical Excellence

Building analytical minds for global financial markets.

Strategic Finance Mastery

Designed to master derivatives, risk, and strategic finance.

Show Detailed Curriculum

Alumni Success

Student Testimonials

Kunal Deshpande

A Quick & Easy Process

Admissions Process

Fill in your basic details & select your preferred institute

Appear for Entrance Test

(CAT / XAT / SNAP / NMAT / MAH MBA CET / MAT / CMAT)

Personal Interviews / ASSET

Attend the interview and take the ASSET (Akademia Schools Skills Evaluation Test)

Final Selection and Enrollment

Clear the final rounds and confirm your admission.

Scholarships

Other CAT candidates may apply for scholarship evaluation.

Candidates scoring 95+ percentilers and above in CAT are eligible for a 100% tuition fee waiver, subject to:Score verification

Admission process clearance

Limited scholarship seats

Know More

Top PGDM Institutes *

Skills Centres

Ask Us Anything

Ready To Redefine Your Future?